capital gains tax canada changes

The news release that accompanied the. If a change to the capital gain inclusion rate is announced.

Canada Crypto Tax The Ultimate 2022 Guide Koinly

To eliminate tax avoidance opportunities the inclusion rate should also rise to 80 per cent for capital gains realized by corporations which would raise the revenue impact to an estimated 190 billion annually or 57 per cent of all federal and provincial income tax revenues.

. The tax base includes profits or losses made by selling investments such as stocks bonds mutual funds and listed securities. You change all or part of your principal residence to a rental or business operation. This increased to 75 in 1990 and was then reduced back to 50 in 2000 where it has remained for the last 20 years.

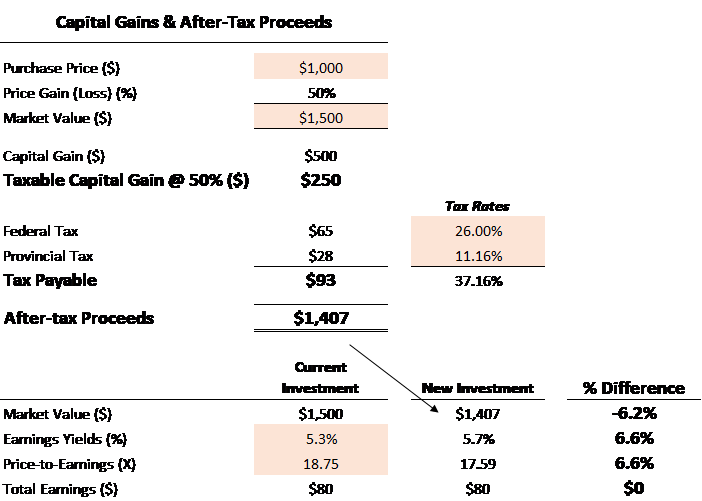

For a Canadian who falls in a 33 marginal tax bracket the income earned from the capital gain of 25000 results in 8250 in taxes owing. Tax Changes in 2022. Increasing the capital gain inclusion rate may be one tax change the Canadian government could consider in order to boost tax revenues.

Capital gains tax changes 2021 canada. As a result changes were made to the Income Tax Act and 50 per cent of all realized capital gains were included in taxable income. NDPs proto-platform calls for levying.

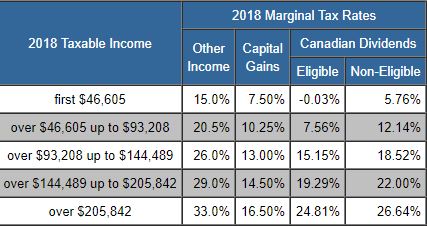

On February 4 2022 the federal government released a package of draft legislation to implement various tax measures Proposals including some previously announced in the 2021 Federal Budget. This has Canada speculating again if a hike to the capital gains inclusion rate may occur in the next federal budget. Over the years the inclusion rate rose from 50 per cent to 6666 per cent and then to 75 per cent before being reduced back to 50 per cent where it stands today.

When the tax was first introduced to Canada the inclusion rate was 50. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. For now the inclusion rate is 50.

While some prognosticators have been crying wolf on this prediction for. The amount of tax youll pay depends on how much youre earning from other sources. And the tax rate depends on your income.

You change your rental or business operation to a principal residence. Lifetime capital gains exemption limit. The Canada Revenue Agency CRA imposes capital gains tax on investment gains realized through the sale of certain assets.

This week the ndps jagmeet singh promised to crack down on big money house flippers. Every time you change the use of a property you are considered to have sold the property at its fair market value and to have immediately reacquired the property for the same amount. Guidance on affidavits and valuations Bill C-208.

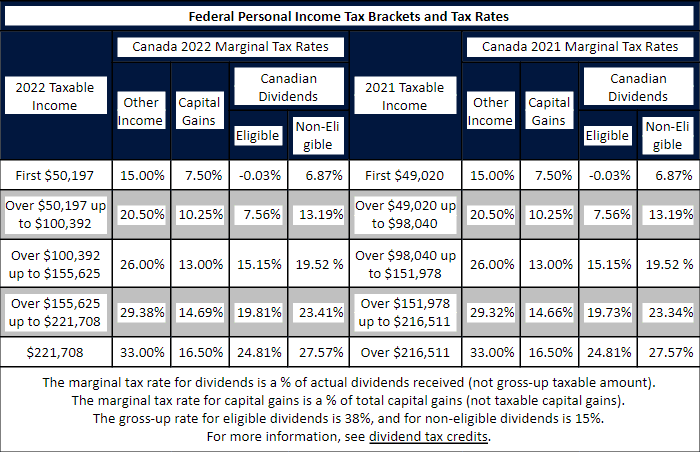

Accelerate Potential Capital Gain Realization. Federal Tax Rate Brackets in 2022. Candidates and their political parties are proposing several changes to the current tax schemes.

For more information see What is the capital gains deduction limit. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for Canadian-controlled private corporations and 24-27 percent for individuals at the highest marginal rate depending on the province. While we cant say for sure whether capital gains will be restricted or the GST will increase below we have covered the tax rate changes in Canada we know about so far for 2022.

In our example you would have to include 1325 2650 x 50 in your income. The sale price minus your ACB is the capital gain that youll need to pay tax on. It was a Liberal government that eventually returned it.

The inclusion rate refers to how much of your capital gains will be taxed by the CRA. Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972. The federal income tax brackets.

For the 2021 tax year and tax season the deadline to file tax returns for most filers is May 2 2022. The Proposals include amendments to both the Income Tax Act ITA and the Excise Tax Act ETA. The taxes in Canada are calculated based on two critical variables.

For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to 892218. The rate of capital gains in tax in Canada has changed several times since it was introduced in 1972. In Canada 50 of the value of any capital gains is taxable.

You have to report the resulting. A capital gains tax increase would be a form of annual wealth tax that would be. Between 1984 and 1994 there was a 100000 lifetime capital gains exemption that applied broadly to most capital assets.

The cra has increased indexation rates to 24 for the next year up from 1 in 2021. For tax purposes the gain would only be half of 35. Feb 7 2022.

While it might seem like a tax the rich policy from Canadas left-leaning party the right-leaning Conservatives raised the capital gains inclusion rate to 6667 per cent from 50 per cent in 1988 and boosted it again to 75 per cent in 1990. There have been ongoing rumors about the Canadian government potentially increasing the capital gains inclusion rate from its current level of 50 to a higher level or changing the exemption for capital gains on principal residences. Generally capital gains are taxed on half of the gain.

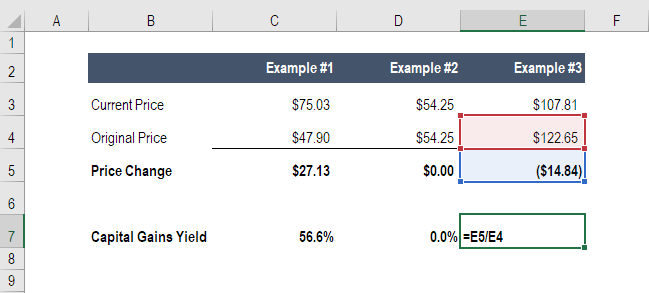

Once you have realized your capital gains off of an investment asset you need to pay taxes on them as well. For example if you bought a stock for 10 and sold it for 50 but paid broker fees of 5 you would have a capital gain of 35.

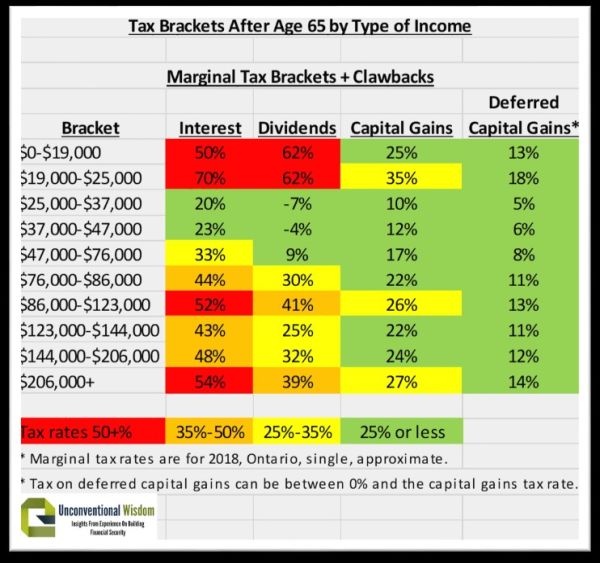

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Capital Gains Tax In Canada Explained

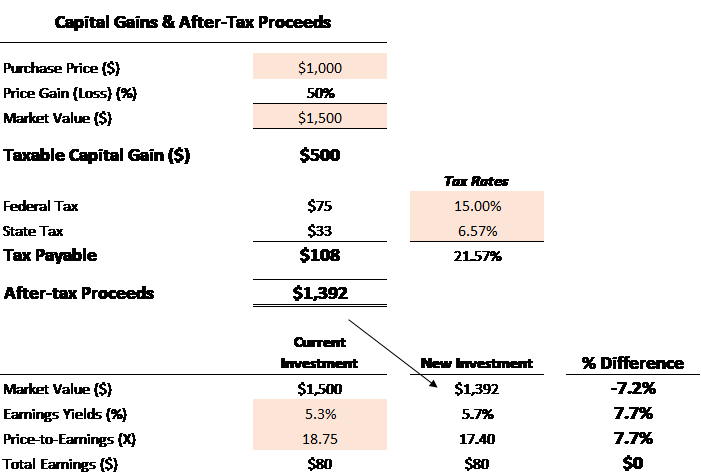

Capital Gains Tax Calculator For Relative Value Investing

Canada Crypto Tax The Ultimate 2022 Guide Koinly

6 Ways To Avoid Capital Gains Tax In Canada Reduce Capital Gains Tax Canada Youtube

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Tax Brackets Canada 2022 Filing Taxes

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Understanding Taxes And Your Investments

Capital Gains Tax Calculator For Relative Value Investing

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Taxtips Ca Manitoba 2021 2022 Personal Income Tax Rates

Taxtips Ca Canada Federal 2017 2018 Income Tax Rates

Capital Gains Yield Cgy Formula Calculation Example And Guide

How Tax Rates In Canada Changed In 2022 Loans Canada

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us